Questions around the foreign gift tax typically arise when an American receives money from a non-U.S. person. Chief among these are: “Do I have to pay tax on a foreign gift?” and “Do gifts count as income?”

The short answer to both of those questions is "no," at least as far as the IRS is concerned. But, there are some key details to be aware of lest you unknowingly trigger financial penalties by the IRS.

In this article, we’ll review in more depth what qualifies as a foreign gift, why the value and giver of the gift matters, and how to correctly declare a foreign gift on your U.S. tax return.

A “Gift from Foreign Person” (Defined By the IRS)

A foreign gift includes cash or property that is given to a U.S. taxpayer by a non-U.S. person.

Now, if that U.S. taxpayer is living outside the U.S., there may be foreign tax implications of receiving a gift. Those specifics will depend on the tax jurisdiction you reside in at the time of receiving the gift.

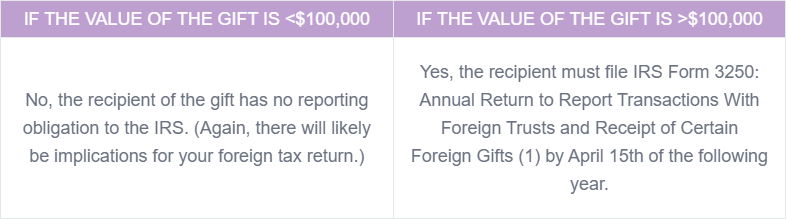

For the purposes of U.S. tax, however, receiving a gift from a foreign person only requires reporting action if the gift or bequest is worth more than $100,000.

If the gift is cash in a foreign currency, then the USD equivalent is determined by looking at the conversion rate on the day the gift was received.

Must You Report a Foreign Gift?

You can see, based on the name of the form that it concerns foreign trusts as well, but for the purposes of this article, we are focusing only on gifts made by a human foreign person.

Although it can be onerous to add another filing requirement to be U.S. tax compliant, the silver lining here is that Form 3250 is an information return and not a tax return. This means that you are not liable to pay taxes on the information you include on the form with respect to the amount of your foreign gift.

Other examples of information returns include FinCen Form 114 (FBAR) and Form 8938 (FATCA).

How To Report a Gift from a Foreign Person

Reporting a qualifying gift from a foreign person requires completing Part IV of IRS Form 3250. (2)

Important Caveats: Determining Whether You Need to File Form 3250

When determining the total value of a foreign gift, the threshold applies to the sum total of all gifts, even if they were given:

- at different points throughout the year and/or

- by different family members.

Worth mentioning: In cases where the givers are not related, the value of the gifts would be counted separately.

Triggering Foreign Gift Reporting: An Example

Imagine that in 2024, Arabella, a U.S. citizen, married Martin, a Swiss citizen.

Part of their wedding gifts include 65,000 Swiss francs from Martin’s grandparents and 40,000 Swiss francs from his parents.

In 2025, Arabella would be required to file part IV of Form 3250 because the sum total of the gifts she received from foreign people equaled more than $100,000.

It’s worth noting that while the “source” is considered the same when gifters are related, the amounts from each party will typically be disclosed individually.

Additionally, if a gift generates income, such as a rental property, then that is taxable, even though the base gift of the property is not.

Requesting a Deadline Extension to File Form 3250

To request an extension to file Form 3250, file IRS Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information and Other Returns. If accepted, the updated deadline to submit Form 3250 will be October 15th of the same year.

Penalties for Failure to File Form 3250

The penalty for failing to file (or incorrectly filing) a Form 3520 that should have reported a foreign gift or bequest is steep: 5% of the gift or bequest for each month during which the failure continues. This penalty applies up to a maximum of 25% of the gift. (3)

Moreover, in some instances, the IRS may personally reach out if they determine Form 3250 is missing from your tax return.

In this case, the U.S. person has 90 days to file the form or else be subject to a further penalty of $10,000 for each additional 30 days of noncompliance.

There is no statute of limitations for the IRS to impose penalties, and these may be applied for face-palm stressful reasons, including the following:

- late,

- incomplete, and/or

- incorrect.

Going Further

If the IRS pursues penalties for failure to file Form 3250, normal deficiency rules do not apply. This means that the U.S. taxpayer must pay the entire penalty before challenging the penalties in court.

Closing Notes

While this article is principally concerned with reviewing the Form 3250 requirement as applied to gifts from foreign individuals, the scope of the IRS’ definition of a foreign person extends to a host of entities that were not covered.

These entities have a host of complex implications for both tax filing and planning purposes, making it imperative for U.S. taxpayer recipients of foreign gifts to ensure they take proactive steps to declare them correctly and in a timely manner.

Foreign Gift Tax: FAQ

What is the difference between Form 709 and Form 3250?

The main difference is that Form 709 is filed by the giver of a gift when that gift exceeds certain thresholds and the giver is a U.S. taxpayer.

Is there a gift tax from foreign parents?

There is no U.S. gift tax associated with the receipt of a gift from foreign parents. However, if the monetary value of the gift exceeds $100,000, there is a mandatory information return to complete, Form 3250.

References

- Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

- About Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

- LB&I International Practice Service Process Unit – Audit (See: Failure to File the Form 3520/3520-A - Penalties)

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland.