Our Process & Client Experience

Financial Planning Onboarding Process

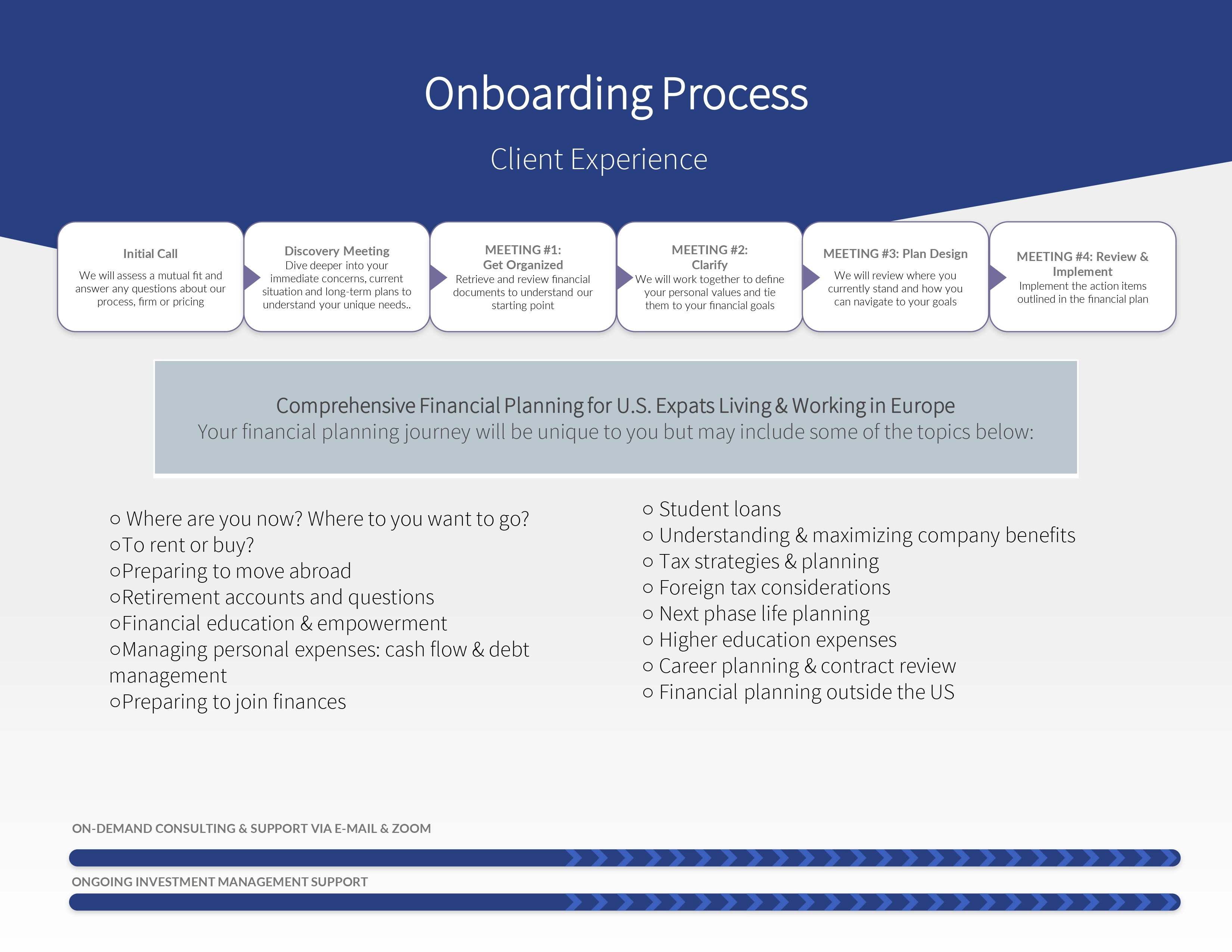

Each onboarding experience is unique to you but generally takes 3-6 months, depending on client complexity and time restraints.

- Initial Call (30-45 minutes): We will use this time to assess a mutual fit and answer any questions about our process, firm, or pricing.

- Discovery Meeting (45-60 minutes): We will dive deeper into your immediate concerns, current situation, and long-term plans to understand your unique needs. After this meeting, you sign the agreement and pay our onboarding fee.

- Meeting #1: Get Organized (60 minutes): We will send you a list of documents to upload before our first meeting and will use this meeting to make sure we have complete information.

- Meeting #2: Clarify (60-90 minutes): At this time, we will tie off any loose ends or missing documentation discovered during our deep dive into your uploaded documents.

- Meeting #3: Calculate Plan Design (60-90 minutes): By now, we will have plugged your financial and tax data into our models to understand how your situation may change under different life scenarios. We will discuss the underlying assumptions and factors that shape the model.

- Meeting #4: Review & Implement (60-90 minutes): It is time to review the information we have provided, make a plan, and act based on it.

- Annual review of investment and retirement accounts (ongoing investment management throughout the year with option “investment management”)

- Budget Meeting: review current cash flow and check in on savings and spending rate. Answer any questions about upcoming purchases (car, real estate, a big trip, wedding, etc…)

- Tax Review & Retirement Contributions: be prepared for your annual tax filings by gathering documentation and questions about how changes in your personal situation may affect your tax situation (marriage, divorce, children, move, job change, etc…). Ensure you are optimizing your retirement savings based on the country where you currently reside and where you plan to retire.

- Insurance Review: We don’t sell insurance, but we generally recommend at least obtaining term-life insurance if you have anyone who depends on your income. We will review any insurance policies you currently have and make recommendations on the appropriate coverage.

- Estate Plan Review: review all accounts, confirm beneficiary information and current estate plan.

- Education: We will calculate and plan for education costs and look for savings and tax planning opportunities. If you have student loan debt, we will review repayment strategies.

- Charitable Giving: We will review your current charitable giving target and look for opportunities to maximize your annual gifting and legacy.

- Employee benefits review: Do you understand your employee benefits? Are you leaving free money on the table? Should you sign that new contract? We can help you sort these out.

- Prep for the upcoming year: tax law changes, international move, change in jobs? We’ve got you covered and will keep you updated and on track.

- Connection to additional services: If necessary, Connected Financial Planning can connect you via our professional network to immigration, estate, tax preparation, and real estate services in various jurisdictions.

Planning Service Fees

Our Fees

As fee-only advisors, our compensation solely comes from our clients. In simpler terms, we neither receive nor accept commissions or kickbacks from brokers, banks, or any third parties. This commitment ensures that our client's best interests consistently take precedence. Should any potential conflict arise, we are dedicated to transparently disclosing it, empowering you to make informed decisions. The fee structure is customized to reflect your preferred management approach for your investment accounts. Your financial objectives remain our foremost priority throughout our partnership. Remember, if it’s free or cheap, YOU are the product.

Financial Planning with Ongoing Wealth Management Support

For clients who looking for financial planning and investment management wrapped into one, we’ve partnered with a cross-border investment management firm to bring you integrated financial planning and wealth management support. The annual fee is split into quarterly amounts and paid from your investment account. The annual fee is based on complexity; the minimum fees below are for simple situations. We generally meet twice a year, with support as needed between meetings.

- Individual Planning: from $5,300 per year

- Family Planning: from $6,360 per year. We include families of all kinds in this tier, including married, partnered, & individuals with dependent children.

Comprehensive Financial Planning and Investment Management support are available for all clients.

Wealth management is billed in addition to our financial planning fee, which is generally 0.70% of assets under management when combined with ongoing financial planning.

Advanced Planning & Tax Concierge Service

This solution is available for busy professionals who want us to fully coordinate their US and local (foreign) country tax situations. Prices will be based on the complexity of the situation, the number of country filing obligations, and the forms that need to be filed.

- From 25,000 / Year (USD/CHF/EUR)*

We charge a one-time onboarding fee of 2,500 (USD/CHF/EUR)* for individuals and 3,500 (USD/CHF/EUR)* for families.

Custom Projects

*As of January 2025, we are at capacity for custom projects through July 2025. If you have an immediate question, we invite you to book a paid consultation here.

We are passionate about serving clients with a diverse range of planning needs. We are happy to take on custom projects as we have capacity. Our lead planner's hourly rate is 450 (USD/CHF/EUR), and the associate rate is 350 USD/CHF/EUR. Our minimum project fee is 2,700 USD/CHF/EUR.

*Clients resident in Switzerland are subject to 8.1% VAT and billed in CHF when not billed through their investment management accounts.

Considerations For Complex Situations

In any of our above pricing options, we generally define your situation as complex if any of the following applies to you:

- You are a corporate expat on a limited expat contract

- You are planning an international move within the next 12 months

- You own a business, or are you in the process of organizing one

- You are involved or have ownership with foreign entities

- You are considering purchasing foreign real estate within the next 12 months

- You have complex equity compensation considerations

- You are a senior executive with a complex compensation structure

- You have immediate estate planning needs and considerations

- You are planning on retiring within the next five years