Citizenship-based taxation impacts all U.S.-connected people, including citizens, green card holders, and others with U.S. ties.

This article explores the complexities of U.S. expatriate taxation, providing insights for expats and anyone planning to move overseas.

Understanding these regulations helps ensure compliance and minimize tax liabilities while navigating the unique challenges of living outside the United States.

What is Citizenship-Based Taxation?

Citizenship-based taxation is a system where a nation taxes its citizens regardless of residency status. This means U.S. citizens and permanent residents must pay taxes to the U.S. on their global income, no matter where they live or earn that income. The U.S. is one of the only countries that tax based on citizenship. (The other is Eritrea, a country located in the Horn of Africa.)

Unlike most countries that tax based on residency (including Switzerland and Germany), the United States requires citizens to file and pay taxes even if they reside abroad, ensuring compliance with U.S. tax laws irrespective of their physical location.

Citizenship-Based Taxation in Historical Context

The concept of citizenship-based taxation dates back to the Civil War. In 1861, President Abraham Lincoln’s administration introduced income tax to finance the war effort, initially targeting residents.

However, by 1864, the government extended this obligation to all U.S. citizens, regardless of residency, to prevent tax evasion by those fleeing abroad. This principle was codified in the Revenue Act of 1913, which solidified the requirement for citizens to report and pay taxes on worldwide income.

Over the years, additional laws, such as the Foreign Account Tax Compliance Act (FATCA), have reinforced these obligations, emphasizing compliance and global financial transparency. These laws also suggest that, despite efforts by various activist groups such as the Association of Accidental Americans, the U.S. won’t change its approach to taxation anytime soon.

Potential Changes to Citizenship-Based Taxation in the U.S.

In the home stretch of the 2024 U.S. Presidential Election, Donald Trump vowed to end “double taxation” for Americans living abroad. (1) He did not elaborate on his plans and it’s important to point out that a provision to prevent double taxation already exists, the Foreign Earned Income Exclusion.

Whether now-President Trump intends to expand on his initial declaration remains to be seen, although it would be remiss of us to underestimate the potential for upheaval in this realm given the speed at which he has moved to implement drastic changes since his inauguration. This remains an area where we at Connected Financial Planning are watching carefully.

Taxation Based on Citizenship Versus Residency

Most countries use residence-based taxation, where individuals are taxed based on their residency status rather than citizenship.

In this system, only residents of a country are subject to its income tax laws, regardless of their citizenship. The specifics around how each country classifies someone as a resident for tax purposes vary, but in general, they look at where you:

- spend your time (a good starting point is to look at the number of days you’ve spent in the country – 183 days or more may classify you as a tax resident)

- maintain a primary or permanent residence or abode

Other factors may include where your dependents live and where the center of your economic interests are located.

More In Recent Tax News: LaHood Introduces Tax Reform Legislation

In December 2024, more news broke on the topic of how Americans abroad file their taxes with Congressman LaHood’s introduction of a new residency-based taxation bill to Congress.

According to the Congressman’s website: “This bill would permit Americans living overseas to elect to be treated as a non-resident American, allowing them to be subject to U.S. tax only on U.S.-sourced income and gains. According to recent estimates, more than 5 million U.S. citizens are currently living abroad.” (2)

While this is not the first time an attempt has been made to change the filing requirements for Americans living overseas, it remains to be seen whether the effort combined with President Trump’s declaration will produce a different result than previous efforts to reduce the tax-filing burden on Americans abroad.

So, Does a U.S. Citizen Living Abroad Have to Pay Taxes?

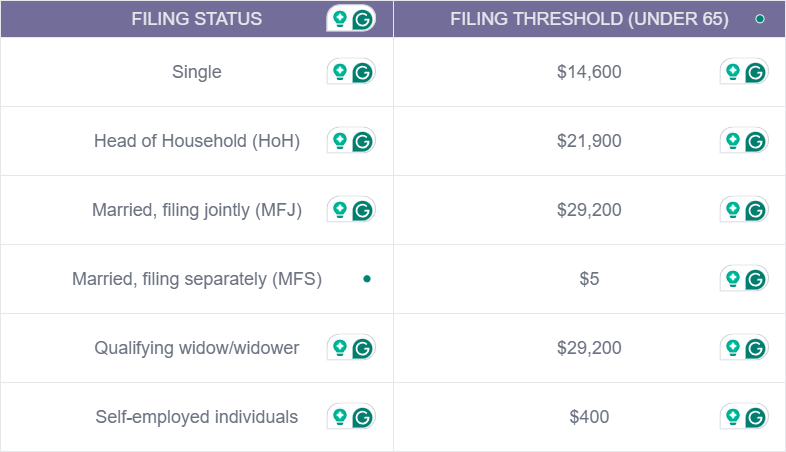

U.S. citizens living abroad must declare their worldwide income if they exceed certain minimum filing thresholds, but they will not necessarily owe. Additionally, they must also report foreign financial accounts through FBAR and FATCA.

With respect to the filing thresholds, filing can be beneficial to claim refunds or credits. For example, the Child Tax Credit is a refundable credit available to all American parents, regardless of whether they reside in the U.S.

Finding a reliable expat tax provider who understands and can explain these provisions and reporting requirements is crucial due to their complexity and potential penalties.

Common Ways to Avoid Double Taxation

The Foreign Earned Income Exclusion (FEIE) allows qualifying expats to exclude up to $126,500 in 2024 (for taxes filed in 2025) and $130,000 in 2025 (for taxes filed in 2026) foreign-earned income from U.S. taxation.

On the other hand, the Foreign Tax Credit (FTC) provides a dollar-for-dollar reduction in U.S. taxes owed for foreign taxes paid. Both are useful, but whether one or both should be applied to your particular situation depends on many different factors.

Minimum income threshold for filing taxes in 2025

As we’ve mentioned, there are minimum thresholds that trigger the U.S. tax filing requirement. Each year, they are adjusted for inflation.

Below, we summarize the thresholds for tax year 2024 (aka the taxes you file in 2025). (3)

Tax Filing Deadline for U.S. Citizens Living Abroad

U.S. taxpayers should be aware that deadlines and extensions exist to ameliorate the added burden of filing from abroad. Essentially, the tax filing deadline for U.S. citizens living abroad is somewhat flexible. Expats may extend their U.S. tax filing deadline up to three times:

- June 15th

- October 15th, and

- December 15th*.

It’s worth mentioning that the first extension happens automatically. There is no action required on your end if you reside abroad and intend to file by the June deadline. An extension to file is not an extension to pay. If you will owe U.S. tax, it’s important to note that the deadline to pay is April 15th, and interest will be calculated from this date.

If, however, you find that you need more time, you will need to formally request it from the IRS using Form 4868. (4)

Finally, the exact date may change if the 15th happens to fall on a weekend or federal holiday. For example, in 2025, the automatic extension deadline is June 16, 2025.

Common pitfalls and mistakes to avoid

Filing American taxes abroad can be complex, and many expats fall into common pitfalls and mistakes. Here are key points to keep in mind:

- Missed deadlines: Be aware of different deadlines and extensions.

- Unreported foreign income: Always report all foreign income to avoid penalties.

- Overlooking or neglecting to file required forms: Ensure you file FBAR and FATCA if applicable.

- Ignoring tax benefits: Strategically claim the Foreign Earned Income Exclusion (FEIE) and/or the Foreign Tax Credit (FTC), and connect with a cross-border tax specialist to ensure you’re not leaving money on the table (e.g., by not claiming the Child Tax Credit).

- Complex tax laws: Seek professional help to navigate cross-border tax regulations, particularly if you hold investments such as foreign mutual funds. Many foreign non-checking accounts may trigger and expensive and challenging filing requirement known as a Passive Foreign Investment Vehicle (PFIC).

- Incorrect or inefficient currency conversions: Use accurate rates for all financial entries and seek to mitigate currency risk.

- Poor record keeping: Maintain detailed records of foreign income and expenses. This is particularly important when you are claiming provisions such as the FEIE which require evidence of a certain amount of days spent residing outside the U.S.

Using a reliable expat tax provider and staying informed about these requirements can help avoid costly mistakes. Additionally, U.S. expats should set up an ID.me account to more easily access multiple government websites. For more information, refer to our article on how to create an ID.me account and verify it for ongoing use.

Do Non-U.S. Citizens Have to Pay Taxes?

Non-U.S. citizens with ties to the United States, such as green card holders or business owners, often have tax obligations similar to U.S. citizens.

If a non-citizen resides in the U.S. for an extended period or engages in business activities, they may be required to pay U.S. taxes on their worldwide income.

One key determinant is the substantial presence test, which assesses the number of days an individual has spent in the U.S. over a three-year period.

If the test is met, the non-citizen is treated as a U.S. resident for tax purposes, meaning they must report and pay taxes on their global income, just like U.S. citizens. This can have significant financial implications for non-citizens.

Note that dual citizens who hold U.S. citizenship will generally be required to file an annual U.S. tax return until and unless they renounce their U.S. citizenship.

Strategies for Managing U.S. Tax Obligations Abroad

Managing U.S. tax obligations while abroad often involves considering tax credits like the Foreign Earned Income Exclusion vs the Foreign Tax Credit to reduce taxable income we discussed earlier. Additionally, proactively seeking out a professional U.S. tax preparer specialized in serving U.S. expats is highly recommended.

Familiarize Yourself With the Tax Treaty Between the Country You Reside In and the U.S. (As Applicable)

The US has tax treaties with many different countries, including most of the EU and EEA. (5) These agreements are designed to shield Americans abroad from double taxation, and each treaty is an individual piece of legislation.

That is to say, the tax treaty between the U.S. and Germany contains different guidelines around how information such as distributions from U.S. retirement accounts should be reported and treated compared to the U.S.-Swiss tax treaty. This is a small part of what makes living abroad so complicated, particularly for high-net-worth and highly mobile individuals and families.

Investment Strategies Are Essential for Minimizing Tax Liability

In some cases, U.S. expats can benefit from tax-efficient accounts such as certain retirement plans that receive favorable treatment in both the U.S. and their country of residence. In others, certain accounts may prove to be highly tax inefficient, warranting an urgent consultation with a cross-border financial planner.

Investing in a cross-border financial advisor can help you avoid falling into common financial planning pitfalls. For example, high-earning expats often need to be mindful of the Net Investment Income Tax (NIIT), which imposes a 3.8% tax on investment income at a certain investment income threshold.

By aligning investments with U.S. tax laws and utilizing professional advice, expatriates can effectively reduce their overall tax burden while safeguarding their financial future.

Frequently Asked Questions (FAQs)

Do U.S. citizens pay more taxes than other countries?

While it may feel natural to assume that because U.S. citizens have more overbearing tax reporting requirements than other countries, they pay more in taxes, the fact is that U.S. citizens do not necessarily pay more in taxes.

According to the OECD, “The United States ranked 32nd¹ out of 38 OECD countries in terms of the tax-to-GDP ratio in 2023.” (6)

Does a dual citizen pay U.S. taxes?

Dual citizens are still bound by the citizenship taxation regime, so they must file a U.S. tax return with the IRS every year, as well as related informational returns such as an FBAR. The amount they will pay in taxes to the U.S. though, if any, depends on the foreign tax credits or exclusions they qualify for, as well as the skill with which the tax return is done.

What are the penalties for not complying with U.S. tax obligations?

Failing to comply with U.S. tax obligations can result in serious penalties, including fines, interest charges, and even criminal prosecution for willful evasion. As discussed, non-citizens and expatriates often have complex tax obligations, such as reporting worldwide income, meeting the substantial presence test, or facing the Net Investment Income Tax (NIIT).

Utilizing tax credits, deductions, and strategic investments can help manage liabilities, but professional guidance is often the best way to protect your wealth and stay compliant with U.S. regulations, no matter where you live or work.

Is it possible to end citizenship-based taxation?

While there are some grassroots movements within the community of Americans abroad (particularly accidental Americans), it’s unlikely that citizenship-based taxation will end.

And while there is potential for reform per recent declarations by President Trump around ending double taxation for Americans abroad and initiatives such as Congressman Lahood’s bill to change the country’s taxation model for U.S. expats, in the short term it remains likely that the filing requirements will remain the same as they have.

References

- Trump Vows to End ‘Double Taxation’ of Overseas Citizens | Tax Notes

- LaHood Introduces Bill to Modernize Tax System for Americans Living Overseas

- IRS provides tax inflation adjustments for tax year 2024 | Internal Revenue Service

- 2024 Form 4868

- United States income tax treaties - A to Z | Internal Revenue Service

- Revenue Statistics: Key findings for the United States

About the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent. She's spent the last decade living between the US, Germany, and Switzerland. She is passionate about helping other U.S. expats and Americans living abroad achieve their dreams with the right financial and tax planning. Connected Financial Planning offers a complimentary introduction call for individuals and families seeking ongoing, comprehensive planning. You can schedule a call here.