Taxes on American citizens living abroad are important to understand whether you’re a current U.S. expat or still planning your move overseas.

Filing a U.S. tax return from abroad (also known as doing U.S. expat taxes) can be extremely challenging. Expatriate tax returns are completed via the familiar IRS Form 1040 but involve understanding and correctly applying the correct expat tax exclusions and credits.

In this article, we take a six-step approach addressing how to file U.S. expatriate tax returns and answer common questions related to expat tax filing in 2025.

Step 1: Understanding the Basics of U.S. Expatriate Taxation

The taxation of American citizens living abroad is a unique concept in the world of tax regimes. Unlike nearly every other country, the U.S. operates a citizenship-based taxation approach. In a nutshell, this means that your worldwide income is subject to U.S. taxation.

Generally, if you meet the following two tests, you are required to file a U.S. expat tax return:

- You earn more than the minimum income threshold for your filing category (see below)

- You are a U.S. citizen (includes dual U.S. citizenship holders), a permanent resident (green card holder), or a U.S.-connected person (e.g., a foreign entrepreneur with business dealings in the U.S.)

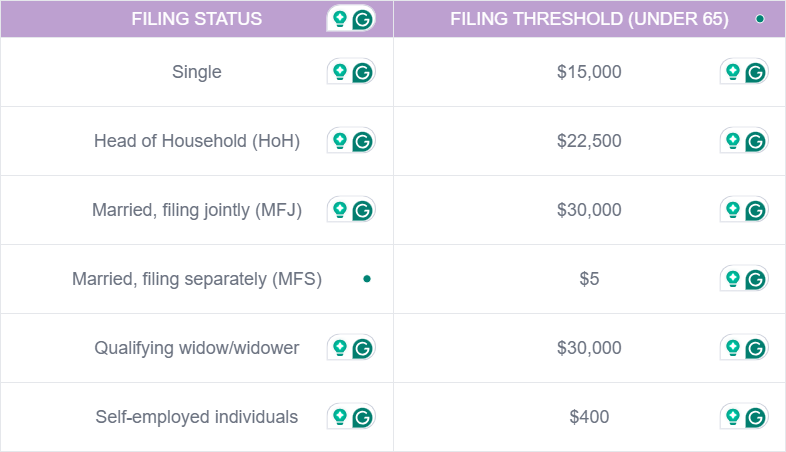

Expat Taxes: 2025 U.S. Income Tax Filing Thresholds

The filing threshold varies depending on your status, but, as you’ll see, filing is typically required:

All figures noted are for the 2025 tax year. There are additional thresholds for those over 65.

Step 2: Learning How to File Taxes as an Expat

So, you’ve determined that you do need to file a U.S. tax return from abroad. Now what?

First, you’ll want to understand the difference between earned and unearned income.

- Earned income: refers to money received for work performed, such as wages or salaries.

- Unearned income: the same thing as passive income, which refers to income gained through investments, interest, foreign rental properties, and retirement distributions, among others.

Finally, all figures on your tax return must be converted into U.S. dollars. To do this, you can use the IRS yearly average currency exchange rates. U.S. (1)

U.S. Taxes Overseas and Self-Employed Expats

Self-employed expats might need to pay U.S. Social Security and Medicare taxes (15.3% in 2024) on their earned income.

Note: If you are paying into the social security scheme of your country of residence, you may be exempt. You can double-check by confirming if a Social Security Totalization Agreement exists with the US and your country of residence. You can find this information on the SSA.gov website. (2)

Navigating Foreign Tax Filing Deadlines and U.S. Expat Tax Extensions

In most cases, the foreign return is required to complete the U.S. tax return. So, expats do their U.S. tax return after completing their foreign taxes. To accommodate expats, the IRS offers multiple extensions beyond the standard April 15 deadline. It’s important to note that April 15th is still the deadline to pay. If you have a balance due and pay after this deadline you will be assessed interest from April 15th.

The completed foreign tax return is typically necessary prior to filing your U.S. tax return because it demonstrates that you qualify for any exclusions, credits, and provisions that you claim.

2025 Tax Deadlines

Step 3: How to File a U.S. Expatriate Tax Return

As we mentioned, filing U.S. taxes from overseas still begins with a 1040.

In this section, we’ll review common forms, filing obligations, and thresholds that are important to be aware of.

Common U.S. Expatriate Tax Forms

IRS Form 2555 - Foreign Earned Income Exclusion (FEIE)

The FEIE allows you to exclude up to $126,500 (for tax year 2024) of foreign-earned income from taxation by the IRS. For tax year 2025 (the taxes you’ll file in 2026), the threshold is $130,000.

This provision is typically best for U.S. expats who pay less foreign tax than what they would have in the U.S. and only applies to earned income.

IRS Form 1116 - Foreign Tax Credit (FTC)

The FTC allows qualifying expats to take a doll-for-dollar, non-refundable credit for each dollar paid in foreign taxes, often allowing expats to wipe out their US tax liability.

This provision is typically best for U.S. expatriates who paid more in foreign tax than what they would have in the U.S. It can be used on both earned and unearned/passive income.

Foreign Bank Account Report (FBAR); FinCEN Form 114

U.S. taxpayers are required to file an FBAR if they hold an equivalent of $10,000 USD in any one or more foreign bank accounts. The purpose of the form is purely administrative, providing information to the Financial Crimes Enforcement Network to help the bureau combat tax evasion. (3) To correctly report the foreign currency into U.S. Dollars use the official Treasury Reporting Rates of Exchange rate. (4) This is different from the IRS-provided annual average exchange rates.

Note that the $10,000 threshold refers to the sum total of all money held in foreign bank accounts. So, if you have $6000 and $4000 across two separate German bank accounts at any point in the year, FBAR filing is required.

Foreign Account Tax and Compliance Act (FATCA); Form 8938

FATCA requires U.S. expatriates to report foreign financial accounts exceeding $200,000 (for single filers) or $400,000 (for joint filers) on Form 8938 with their tax return. (5) This is separate from FBAR and ensures compliance with U.S. tax laws on global assets. Non-compliance can result in significant penalties.

IRS Form 8621: Passive Foreign Investment Company (PFIC)

PFIC filing is required for U.S. expatriates who own shares in a Passive Foreign Investment Company (PFIC), such as foreign mutual funds, ETFs, or certain offshore investments. The form reports income, gains, and distributions from PFICs to ensure proper U.S. tax compliance. Failure to file can lead to punitive tax treatment and interest charges on gains.

The catch here is that PFIC filing is often triggered by foreign investment or retirement accounts which are standard practice in most foreign countries. Many foreign employers and banks are unaware of the unique rules governing U.S. expatriates’ best interests, so it’s best to check with a cross-border tax or financial professional before opening any foreign account that is not a checking account.

Step 4: Check If You Need to File a State Tax Return

Most states will require you to pay taxes if you retain what’s referred to as “significant ties.”

The definition of significant ties varies but includes more or less than what’s listed below.

Having the following in the U.S. may trigger state tax filing, even if you reside in a foreign country:

- Property

- Investments

- Voter registration

- Dependents

If you are concerned about a potential state tax filing requirement, it’s best to speak with a cross-border tax expert knowledgeable about expatriate taxes.

Tricky (AKA “Sticky”) States

In many cases, Americans who pack up their lives, move abroad, and file U.S. taxes only have to contend with federal taxes.

However, a handful of states are referred to as “sticky” within the tax community because they are especially difficult to extricate from.

If your last state of residence prior to living abroad was any of the following, you will need to proceed carefully to mitigate your US state tax liability:

- New York

- Virginia

- California

- New Mexico, or

- South Carolina

Step 5: Research Other Expat Tax Provisions

U.S. expatriate tax complexity only increases when you factor in big-picture strategic thinking such as retirement or other international moves.

However, developing your understanding to include key expatriate tax vocabulary is an excellent way to take control of your expat financial management obligations.

Below, we’re rounding up a “quick hits” list of other important IRS tax provisions that remain available to expats too, as well as important bilateral agreements that may be helpful to you.

Child Tax Credit

This credit permits U.S. taxpayers to claim a partially refundable $2,000 tax credit per qualifying dependent child living with you if your income is at or below the given threshold. (6) The Child Tax Credit is not available for expats who file using the Foreign Earned Income Exclusion (Form 2555). If you have dependent children you should compare filing with the Foreign Earned Income Exclusion and Foreign Tax Credit.

Student Loan Interest Deduction

This dedication permits U.S. taxpayers to deduct up to $2,500 in interest paid on qualified student loans.

Note: Married Filing Separately filing status is not eligible for this deduction.

Foreign Housing Exclusion

Like the FEIE, this exclusion is filed with IRS Form 2555. With this exclusion, Americans deduct certain foreign housing expenses from their taxable income. Most expats who qualify for the FEIE are also eligible for the Foreign Housing Exclusion. Housing expenses go beyond rent to include utilities, property insurance, furniture rental, and parking so be sure to add all the expenses to your total to maximize your deduction!

IRA Deduction

U.S. taxpayers can make deductible or non-deductible IRA contributions based on their income and access to a qualified retirement account.

While most taxpayers must meet income thresholds to deduct their contributions, U.S. expats who do not have access to an employer-sponsored U.S. retirement plan are not subject to these income limits. This means they can make traditional IRA contributions regardless of their earnings and may deduct them, providing valuable tax-deferred growth opportunities for retirement.

Additionally, Roth IRA contributions may still be made based on Modified Adjusted Gross Income (MAGI) limits. Work with your tax and financial planning team to ensure you optimize your retirement savings as an expat. (7)

Important Terminology

Below is a roundup of common terminology that's important to familiarize yourself with as a current or prospective U.S. expat.

Double Taxation Treaty

A tax treaty is a bilateral (two-party) agreement made by two countries to resolve issues involving double taxation of passive and active income of each of their respective citizens.

The details of these will vary from country to country and often have significant implications when making cross-border financial planning decisions. It's important to remember that treaties are not created for the benefit of U.S. citizens.

Savings Clause

Most U.S. tax treaties contain a savings clause that allows the U.S. to tax its citizens and residents as if the treaty had not come into effect. This clause ensures that U.S. citizens and residents cannot use the treaty to avoid U.S. taxation on their worldwide income.

As an example see the wording of the savings clause from Article 1, Paragraph 2 of the U.S.-Switzerland Tax Treaty:

"Notwithstanding any provision of this Convention except paragraph 3 of this Article, the United States may tax a person who is treated as a resident under its taxation laws (except where such person is determined to be a resident of Switzerland under the provisions of paragraphs 3 or 4 of Article 4 (Resident)) and its citizens (including its former citizens) as if this Convention had not come into effect." (8)

This clause prevents tax avoidance by ensuring U.S. citizens and residents remain subject to U.S. tax rules regardless of foreign tax treaty provisions.

Totalization Agreement

Totalization Agreements “...eliminate dual Social Security taxation, the situation that occurs when a worker from one country works in another country and is required to pay Social Security taxes to both countries on the same earnings…the agreements help fill gaps in benefit protection for workers who have divided their careers between the United States and another country.” (9)

Note: Questions concerning Totalization Agreements and retirement benefits should be directed to the SSA, not the IRS. There was an extremely positive development in the way the US handles retirement distributions in 2025, learn more about the Windfall Elimination Provision repeal.

Step 6: Select Cross-Border Expatriate Tax and Finance Pros

As you can tell, filing US expat taxes is a complex and deeply personal endeavor.

Doing so correctly often requires expert analytical and research capacities, which is where certified professionals with cross-border expertise come into play. Expat tax professionals are an important part of this picture, however, in complex cases, a cross-border financial planner is essential for setting the CPA up for success. Always confirm that your team has the expertise in your resident country as rules and planning opportunities vary country to country.

If you have plans to move to Europe or already live in Europe, you may be an excellent candidate for personalized cross-border financial planning.

U.S. Expat Taxation – FAQ

How do I file U.S. taxes from abroad?

You begin with IRS Form 1040 like usual, and then research with respect to the expatriate tax provisions that apply best in your situation to minimize your U.S. tax liability.

What happens if you don’t file taxes while living abroad?

Neglecting to file U.S. tax returns as an expatriate risks financial and criminal penalties by the IRS. Consequences vary but in general, the higher your net worth, the steeper the penalties. If you have only recently realized you have outstanding US tax filing obligations the IRS offers programs to come into compliance. We recommend working with a international tax specialist to support you.

References

- IRS Yearly Average Currency Exchange Rates

- Social Security Totalization Agreements

- https://news.bloombergtax.com/tax-insights-and-commentary/global-us-taxpayers-must-plan-carefully-to-comply-with-fbar

- Treasury Reporting Rates of Exchange | U.S. Treasury Fiscal Data

- Foreign Account Tax Compliance Act (FATCA) | Internal Revenue Service

- Child Tax Credit | Internal Revenue Service (irs.gov)

- IRS Traditional IRAs

- What Is the Foreign Housing Exclusion? A Guide for Expats

- Switzerland - Tax Treaty Documents : Income Tax Treaty

- Topic no. 502, Medical and dental expenses | Internal Revenue Service (irs.gov)

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland. Connected Financial Planning offers a complimentary introduction call for individuals and families seeking ongoing, comprehensive planning. You can schedule a call here.