U.S. expat retirement planning often raises complex questions such as, “What to do with a retirement account when moving abroad?” and “Can I still contribute to an IRA if I live abroad?”

Below, we clarify how expatriate retirement works, particularly when you have U.S. pension accounts. We’ll discuss how to manage common retirement vehicles such as IRAs and 401(k)s while living abroad and share resources on setting up accounts such as ID.me.

We'll also discuss transferring retirement accounts and provide insights on establishing an international savings plan with cross-border considerations.

Many U.S. Taxpayers Retire Abroad with an IRA

Individual Retirement Accounts (IRAs) are crucial retirement vehicles for those planning to retire in the U.S. The most common types are Traditional IRAs and Roth IRAs, both of which are qualified retirement accounts. “Qualified” means the account meets certain requirements in the Internal Revenue Code Section 401(a). (1)

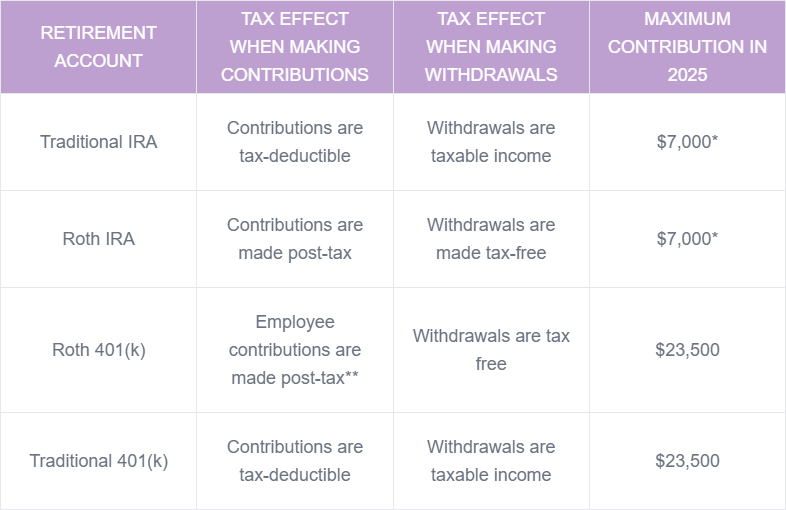

The key difference between the two is in how they are taxed. These differences are also important to distinguish from an international financial planning perspective.

A Traditional IRA involves pre-tax income contributions, which offer immediate tax deductions. Taxes are paid on the distributions you take in retirement.

A 401(k) is an employer-sponsored retirement account that is hugely advantageous for retirement savings. Employers may offer to match up to a certain amount of their employees’ contributions, which is an excellent means of passively adding to retirement savings.

High earners should seek to take advantage of employee-sponsored 401(k) match programs. In 2024, individuals could calculate maximum contributions on up to $345,000 of earned income. We anticipate this to be updated for 2025 around mid-year (1).

Another Common Retirement Vehicle is the Roth 401(k)

Conversely, a Roth 401(k) is a type of IRA that is funded with post-tax income, with no upfront tax break. But, distributions from a Roth IRA are tax-free in retirement.

Both account types grow tax-free. The choice between them hinges on current versus anticipated future tax rates, with Traditional IRAs favoring those with higher current taxes and Roth IRAs benefiting those expecting higher taxes in retirement.

A Roth 401(k) is one of the best retirement vehicles. In most cases, U.S. taxpayers should seek to take full advantage of them because 401(k) contribution limits are much higher than those of IRAs ($23,500 compared to $7,000 for IRAs in 2025). (2)

Important note: Saving for retirement via 401(k) is only possible if someone works for a U.S.-based company that offers a 401(k) plan.

This means that if a working professional with a 401(k) in the U.S. moves abroad and begins working for another employer, they will no longer be able to make contributions to their U.S. 401(k).

What Are Portable Benefits?

Portable benefits are funds that have been paid into an employer-sponsored plan, such as 401(k)s and 403(b)s.

Using Portable Benefits Strategically for Retirement

Portable benefits can be transferred into a new retirement plan, such as an IRA. Depending on the complexity of your situation, you may want to review the following options with a certified cross-border financial planner:

- Rolling the funds into an IRA.

- Withdrawing funds from a U.S.-based account.

- Managing your U.S.-based account from abroad.

- Transferring retirement accounts’ funds from a U.S.-based retirement account into a foreign one.

Visualizing U.S. Retirement Account Differences

*Those aged 50 and above are allowed an additional $1000 in maximum contributions to traditional IRAs and Roth IRAs, so up to $8,000 may be contributed to Traditional and Roth IRAs if you are aged 50 or older.

**According to Charles Schwab: “...most employer's matching contributions are currently pretax and will be placed in a regular, tax-deferred 401(k) account, which means you'll be taxed once you start taking distributions.” (Emphasis added.)

Do I Get Double-taxed if I Retire Abroad?

All U.S. citizens, permanent residents, and qualifying non-US citizens must file a U.S. tax return. This obligation is required by the provisions of the citizenship-based taxation model, which the U.S. has used since the Civil War. However, the requirement to file does not necessarily mean that you will be double-taxed.

Navigating Tax Treaties

The U.S. has dozens of tax treaties with countries around the world whose design is to alleviate the burden of double taxation. However, due to specific clauses, benefits are not always straightforward. Many countries, including Switzerland and Germany, have long-established tax treaties that provide solid footing for insulating your retirement funds against cross-border complications.

⚠️Careful⚠️ U.S. Retirement Account Treatment Abroad Can Vary By Country

Depending on the country you currently live in and the country where you plan to retire, it is crucial to understand how both Traditional and Roth IRA contributions will be treated by your resident country's tax system.

If your country of residence or future retirement destination does not recognize these types of U.S.-qualified retirement accounts, it is essential to clarify the future tax treatment to avoid the risk of double taxation.

There is no one-size-fits-all rule; each country's tax laws must be considered individually. If your future plans are uncertain, this makes planning particularly challenging. This complexity underscores the importance of detailed, country-specific tax planning to ensure optimal financial outcomes for American expats.

Key U.S. Tax Provisions

The Foreign Tax Credit (FTC) is a valuable tool for US taxpayers. It offsets U.S. taxes with taxes paid abroad, potentially reducing U.S. tax liability to zero.

Conversely, the Foreign Earned Income Exclusion (FEIE) lets expats exclude up to $130,000 in 2025 of income from U.S. taxes.

Notably, the FTC and FEIE cannot apply to the same income, and using FEIE may restrict IRA contributions.

Special Considerations When Applying the FEIE as a U.S. Taxpayer

Although the Foreign Earned Income Exclusion (Form 2555) is a commonly-used IRS provision used to reduce U.S. expat taxes, income excluded with the FEIE may not then be put into IRA plans.

One way around this limitation is the strategic application of the Foreign Tax Credit. The FTC allows a taxpayer to claim U.S. tax credits up to the same value of foreign taxes that they’ve paid. And, because the provision is a credit and not an exclusion, it doesn’t affect expats’ adjusted gross income amount. This enables them to make IRA contributions.

Choosing the right approach depends on individual circumstances and nuances that are best parsed with a certified partner.

Learn more about how to evaluate the FEIE vs FTC.

Receiving IRS Retirement Benefits from Abroad

Receiving distributions from qualified U.S. retirement plans while living in another country can be complicated depending on the timing and country in which you’re residing.

Traditional pensions, IRAs, and 401(k) plans are among the most common types of accounts held in the U.S. and tend to be favorably recognized by popular U.S. expat countries in Western Europe.

Crafting a Long-Term International Retirement Savings Plan

Saving for retirement as a U.S. taxpayer abroad requires navigating the complexities of cross-border taxation, managing currency risk, and leveraging U.S. tax provisions effectively.

It’s important to consider tax treaties and IRS provisions and reporting requirements to create a balanced and sustainable approach.

Proactively seeking out professional advice to engage in strategic planning will ensure a robust approach to retirement savings, aligning with both current financial realities and future retirement goals.

Checklist for Expats to Optimize Retirement Planning

Assess Your Current Situation

- List out all of your retirement accounts (401(k)s, IRAs, pensions, etc.) and their current value.

- Estimate future retirement expenses in your chosen country (considering cost of living, healthcare, etc.).

- Determine your risk tolerance and investment preferences (note that these tend to naturally change as we grow older).

- Understand the tax implications of your current accounts in both the U.S. and your country of residence.

Evaluate Your Options

- Compare the benefits of keeping retirement accounts in the U.S. vs. transferring them to a foreign account (if possible and advantageous). It’s worth noting that this can be difficult to do during turbulent times when the news can cause us to make it difficult to think rationally about the stock market and historic market activity.

- Research investment options suitable for expats (considering currency fluctuations, international diversification, etc.).

- Determine eligibility for Social Security benefits and estimate potential payouts.

- Decide whether the FEIE or FTC better fits your retirement strategy (considering IRA contributions).

Create a Plan

- Set clear retirement goals (desired retirement age, income needs, lifestyle).

- Develop a withdrawal strategy for your retirement accounts (considering tax implications and longevity).

- Establish a budget for your retirement income and expenses.

- Implement a plan to manage currency risk (if holding assets in multiple currencies).

Seek Professional Advice

- Consult a qualified cross-border financial advisor specializing in expat retirement planning.

- Engage tax professionals on both the U.S. side and the target country who are used to working with Americans. One tip to work smarter, not harder, here is to research on the U.S. side first and then request one or two referrals to a trusted colleague in their network. Experienced cross-border professionals will have established relationships and a history of working with others in the industry.

- Review your plan regularly (at least annually) and make adjustments as needed.

Estate Planning Considerations

- Address estate planning implications, including wills, trusts, and inheritance taxes in both the U.S. and your country of residence.

What to Do with Retirement Account When Moving Abroad - FAQ

Can you collect Social Security if you retire abroad?

Those eligible for U.S. social security payments will typically be able to receive them abroad, albeit with a few exceptions. (3) A common sticking point with Social Security is navigating the logistics of getting the checks deposited. Some U.S. expats prefer their SS to be deposited into their local bank in local currency, while others are happy to receive the payment directly in their U.S. bank account.

Concerning the taxation of Social Security benefits while living abroad, up to 85% of Social Security benefits may be subject to federal income tax. They may also be subject to taxation by foreign governments, depending on where you reside/earn income.

What happens to a Roth IRA if you leave the USA?

Your Roth IRA remains in the U.S. if and when you leave, however, whether and how much you can contribute to it will depend on your situation.

Can I keep my 401k in the U.S. if I move abroad?

Yes, you may keep your 401(k) if you move abroad, however, you will typically be unable to continue contributing to the plan. This is because 401(k) plans may only be offered by U.S.-based employers who choose to offer the plan to their employees.

References

- A Guide to Common Qualified Plan Requirements

- 2024 Limitations Adjusted as Provided in Section 415(d), etc.

- 401(k) limit increases to $23,000 for 2024, IRA limit rises to $7,000

- Your Payments While You Are Outside the United States

Additional resources

Meet the Author

Arielle Tucker is a Certified Financial Planner™ and IRS Enrolled Agent with Connected Financial Planning. She's spent over a decade working with U.S. expats on U.S. tax and financial planning issues. She is passionate about working with U.S. expats and their families to help secure a financial future that is reflective of their core values. Arielle grew up in New York and has lived throughout the U.S., Germany, and Switzerland.