For some, when the opportunity arises to move to Germany from the US, the decision of whether or not to move and contribute to the largest economy in the European Union can feel like a no-brainer. (1) For others, moving to Germany as an American may not be a clearly defined path, but in both instances, the appeal of the country is clear.

Commonly cited advantages of moving to Germany include an affordable healthcare system, reliable public transportation, and strong protections for full-time employees—all of which are generally true compared to the U.S.

However, Americans moving to Germany should be mindful of the financial implications of moving abroad. Below, we review several important questions Americans moving to Germany should seek to answer prior to their departure.

First things first: How to move to Germany as an American?

There are several different immigration pathways available for those seeking to move to Germany from the US.

The best one will depend on various factors, including your age and phase of life, but in general, Americans could consider the following options when planning how to move to Germany:

- applying for jobs that would qualify you for the skilled worker visa (2)

- researching US military service opportunities in Germany

- applying for the self-employment freelancer (Freiberufler) visa (3)

- enrolling in a German university to obtain a student visa

- researching eligibility for US-Germany dual citizenship

Do I have to file taxes in Germany?

U.S. citizens who move to Germany for work will be liable for filing two tax returns. The first is the annual German tax return and the second is a U.S. tax return; this is also typically the order in which the returns will be filed. As we’ll discuss later though, being required to file a tax return in both Germany and the U.S. does not mean you’ll be double-taxed.

All U.S. expats must continue filing a U.S. tax return with the IRS. This is because, unlike most other countries, the U.S. operates a citizenship-based taxation model. Dating from the Civil War period, this form of taxation requires all U.S. citizens, green card holders, and U.S.-connected people to file an annual tax return.

Does Germany have a Double Taxation Agreement with the U.S.?

Yes. The U.S.-Germany tax treaty was signed at Bonn in 1989 and has been generally in effect since 1990. (4) This document provides relief from double taxation through provisions such as foreign tax credits and determines which country has primary taxing rights for various income types.

Additionally, the Double Taxation Agreement guides professionals in ascertaining tax residency, which can be extremely useful for planning when to move to Germany. The treaty also outlines rules for specific income sources, e.g., dividends and pensions.

Note that Social Security benefits for individuals working in both countries are handled by the US-Germany Totalization Agreement, which is a separate agreement managed by the Social Security Administration, not the IRS. (5)

Should You Sell or Rent Your U.S. Residence?

If you’re a U.S. homeowner moving to Germany, you will need to decide whether to rent or sell your home when you move.

There are many factors to consider and the right decision will vary from family to family. In general, you should consider:

- State tax implications: In many states, retaining ownership of a property could make you liable for ongoing state tax return filings.

- The permanency of the move: Depending on whether your move to Germany is temporary or permanent, selling your U.S. residence may or may not make sense (particularly if you own in a state where property costs are particularly high).

- Capital gains tax: In general, if you decide to sell your property prior to moving, it’s in your best financial interest to complete the sale of the property before leaving to ensure maximum agility and financial gain within the federal and relevant state tax laws.

- German taxation of rental income derived from U.S. rental property: Germany does not tax rental income derived from real property located in the U.S.; however, the income is still reported and considered for determining the marginal tax rate in Germany.

Which tax and financial professionals do you need to connect with before moving to Germany?

In general, we recommend that our clients work with the following professionals when organizing their finances for a move to Germany:

- U.S. Cross-Border Tax Expert (CPA or EA): This professional should have explicit expat experience and, ideally, clientele based in Germany – bonus points if they’ve been an expat in Germany themselves!

- German accountant (Steuerberater): This professional should have experience working with U.S. expats. If you do not speak German, seek out an English-speaking Steuerberater.

- Cross-border financial planner with expertise in Germany: Generally recommended for families with a mix or either high-income or complex income structures and with a net worth above $350,000 and other high-net-worth individuals to plan for the ongoing growth and maintenance of their wealth in the new cross-border context.

What are the potential ramifications on your U.S. bank accounts?

When you move abroad and your tax residency changes, your account setups are scrutinized according to different rules and regulations. As an American moving to Germany, your U.S. bank accounts will need to be reviewed from a cross-border perspective.

For example, tax-privileged accounts in the U.S., including Roth IRAs, HSAs, and 529s are implicated under German tax law and treated differently, necessitating a proactive plan to accommodate and mitigate this difference.

In general, it’s best to consolidate accounts where possible

This will make managing them from abroad easier. The bank accounts that remain open when you move abroad are best when managed by banks known to be friendly to US expats (e.g., Charles Schwab or Interactive Brokers).

If you neglect to do your due diligence around your ability to maintain your U.S. bank from abroad, an unexpected con of moving to Germany from the USA can be having your U.S. bank account closed if your bank learns you’re no longer a U.S. resident.

Should you tell your U.S. bank that you’re moving to Germany?

In general, short-term moves are received more favorably than permanent relocations. For a deeper dive on this topic, check out a recent episode of the Passport to Wealth podcast where my co-host and I deep dive into how to manage bank accounts from abroad.

Getting familiar with the types of tax in Germany

Germany levels many different types of taxes, but the three main ones are as follows:

- Bundesregierung: federal government tax

- Bundesländer: federal states tax

- Gemeinden: municipalities tax

If you’re moving abroad to work in Germany, your German CPA should be able to give you a solid understanding of the types of German taxes you can expect to pay.

Tip: If you are moving with a full-time work contract, an international immigration attorney will be able to review your contract prior to signing to ensure that it’s optimally structured for your financial benefit.

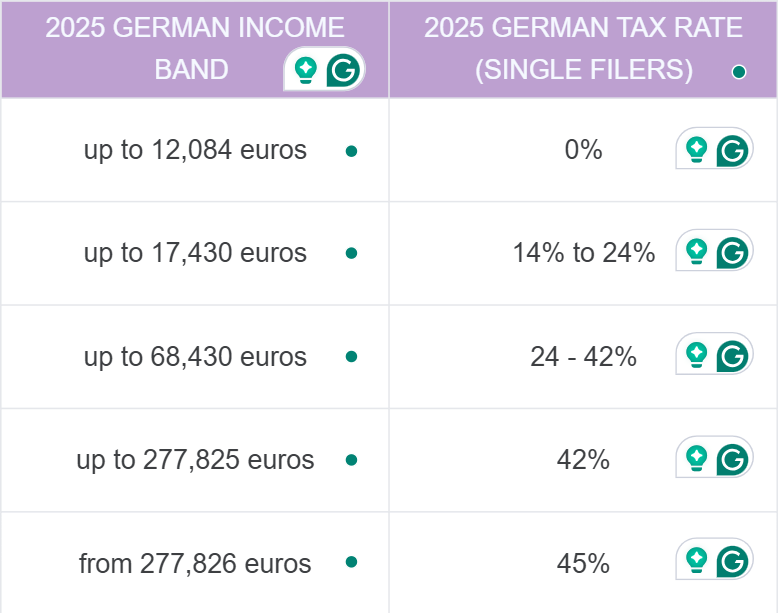

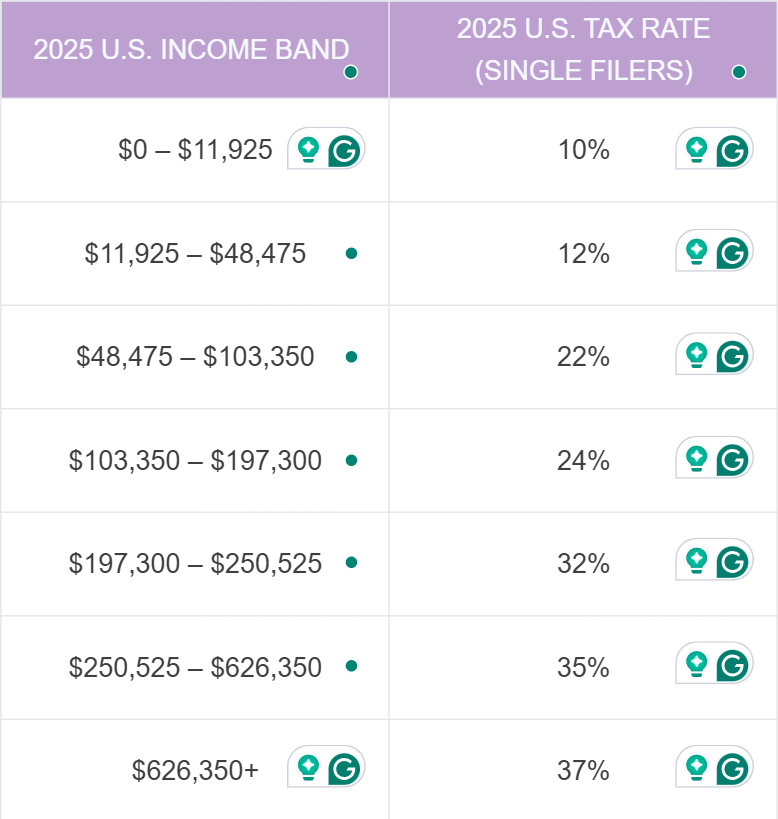

As mentioned earlier on, German tax rates look quite different from those in the U.S. Below is a quick overview of individual federal government tax rates in Germany, followed by the same for the U.S. (6,7)

Capital gains tax in Germany

Germany imposes a flat capital gains tax rate of 25% on investment income. Additionally, there is a 5.5% solidarity surcharge applied to the capital gains tax, as well as an 8-9% church tax, depending on the federal state, both of which are calculated based on the amount of capital gains tax owed (8).

Certain exemptions to capital gains tax exist:

- Crypto gains are not taxed if the holding period exceeds one year, making long-term cryptocurrency investments tax-free in Germany (9).

- Pre-2009 holdings are exempt from capital gains tax, meaning investments acquired before January 1, 2009, are not subject to the current tax structure (10).

Understanding these rules and exemptions is essential for effective tax planning, especially for expats navigating Germany's financial landscape.

Inheritance tax in Germany

Understanding the nuances of estate and inheritance for U.S. citizens living abroad is essential to managing wealth across borders. In addition to complex cross-border considerations, all U.S. expats stand to benefit from learning about the nuances of cross-border estate planning. This is particularly important with respect to reconciling U.S. federal and state estate plans with planning to mitigate Germany’s inheritance tax (as applicable).

Final thoughts and next steps

Moving to Germany as an American comes with a host of potential benefits, particularly if you’re moving abroad with family.

That said, it’s important to be aware that moving abroad is not a cure-all for the frustrations of daily life in the U.S. Germans are sticklers for processes and rules (even though the latter are often confusing as expats) and proficiency in German is often a prerequisite for proper integration.

Additionally, as we’ve noted, there are very specific financial considerations Americans moving to Germany should consider well before moving.

Schedule a consultation today to discuss the role cross-border financial planning plays in navigating an international move.

How to Move to Germany as an American – FAQ

How much does it cost to move to Germany?

The answer to this question depends greatly on the individual. The cost to move to Germany will look completely different depending on whether you’re a single professional moving to Germany for a work opportunity, a young couple with no dependents, a family with children and pets, or any of the many other combinations that go into the profile of a prospective expat.

Since the cost to move to Germany as an American can vary so widely, we encourage those planning a move to research the one-time fixed costs associated with moving (such as the flight ticket(s), immigration attorney support, the cost to obtain an apartment or home, shipping, pet relocation veterinary appointments and support, etc) and organize that information separately from your usual budget. Once you have the expected costs of the move alongside your working budget, you can adjust your working budget to account for the savings that will need to go into moving to Germany.

In general, if you are in a good financial position and find a viable immigration pathway, you can generally move to Germany within 1-2 years of deciding to do so.

References

- Key facts and figures | European Union

- Moving to Germany as a skilled worker - Federal Foreign Office

- BAMF - Bundesamt für Migration und Flüchtlinge - Self-employment and freelancing

- U.S.-Germany Double Taxation Treaty

- Totalization Agreement with Germany | International Programs | SSA

- Income tax table – Germany

- Federal Income Tax Brackets for Tax Years 2025 and 2024

- Kapitalertragsteuer: What you need to know about capital gains tax in Germany – firma.de

- Crypto Taxes in Germany: Complete Guide [2024 & 2025]

- When you need to pay withholding tax in Germany